Simplify Early Retirement: Top Platforms for Passive Income Streams in 2025

Let’s be honest, the old idea of working for forty years and then suddenly stopping feels more like a relic than a plan. What if you could design a life where your money does the heavy lifting long before your hair turns gray? Building passive income streams is exactly that: creating multiple channels of cash flow that don’t rely on you trading hours for dollars.

Sustainable income comes from putting consistent, small efforts into the right systems. The platforms we’re looking at help you build this future, from learning the fundamentals to managing your investments. Think of it as assembling a personal toolkit for financial freedom.

The Foundation: Learn Before You Earn with Finelo

Jumping into the investing world without a map is a surefire way to get lost. Before you commit real capital, you need confidence. This is where a platform like Finelo makes a real difference. It’s built for anyone who feels overwhelmed by financial jargon or nervous about making their first trade.

Finelo.com operates on a simple principle: practice makes profit.

Their standout feature is a real-world investing simulator that lets you test strategies with virtual money based on live market data. You can explore over 120 assets, use interactive charts, and get a feel for the markets without the sleepless nights. It’s like a flight simulator for your finances.

Beyond the simulator, Finelo structures learning into bite-sized, interactive lessons and personalized pathways that cover everything from stock market basics to crypto and personal finance. An integrated AI mentor is on hand to answer questions as you learn.

The platform demystifies complex topics, ensuring you build a solid foundation of knowledge. The focus is purely on education. It gives you the skills for smarter money decisions. This is the most critical first step for building wealth.

The Real Estate Backdoor: Fundrise for Property Investing

Not everyone has the cash or desire to become a landlord, but nearly everyone understands the power of real estate. Fundrise opens that door without you ever having to fix a toilet. It’s a platform that lets you invest in a diversified portfolio of commercial and residential properties across the United States, all online.

Think of it as pooling your money with other investors to buy into large-scale projects like apartment complexes, warehouses, and new housing developments. You become a partial owner in these properties and earn money through two main channels: potential dividends from rental income and potential appreciation in the value of the property over time.

The main appeal of Fundrise is its accessibility.

You can get started with a relatively small amount of money, breaking down the huge barrier to entry that traditional real estate presents. They handle all the management, from tenant screening to property upkeep. Your involvement is mostly hands-off, making it a genuinely passive way to add real estate exposure to your portfolio and build a stream of income from property markets.

The Peer-to-Peer Lender: Earning Interest with Prosper

Banks have always made money by lending out deposits and keeping the interest. Platforms like Prosper let you step into the bank’s shoes. It’s a peer-to-peer lending marketplace where you can fund personal loans for other people and earn the interest they pay back.

Here’s how it works: individuals apply for loans on Prosper for things like debt consolidation or home improvement. You, as an investor, can browse these anonymized listings and choose to fund small pieces of many different loans. This spreads your risk around. Instead of lending $10,000 to one person, you could lend $25 to 400 different people.

Your return comes from the interest payments on those loans. Prosper provides historical data and risk ratings for borrowers, giving you tools to make informed choices. While there is a risk of borrowers defaulting, the platform’s structure is designed to mitigate that through diversification. It’s a more active form of passive income than Fundrise, requiring you to select loans, but it can generate a consistent cash flow directly into your account.

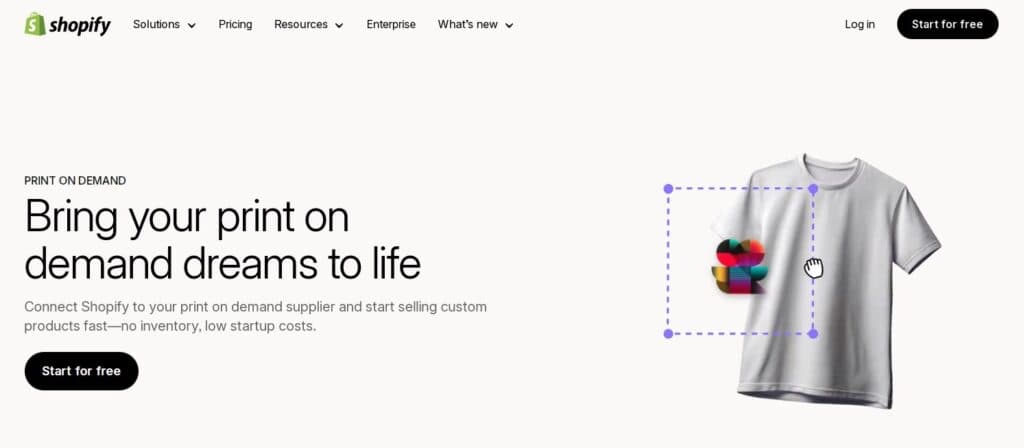

The Digital Landlord: Building a Niche with Shopify

If creating and selling physical products sounds appealing but the idea of managing inventory and shipping gives you hives, Shopify combined with a print-on-demand service is your answer. This model turns you into a digital landlord for your own branded products.

You use Shopify to build a sleek online store, but you don’t hold any stock. Instead, you connect your store to a print-on-demand partner. You design t-shirts, mugs, or posters, and when a customer places an order on your site, the partner automatically prints that specific design on the product and ships it directly to your customer. Your profit is the difference between your selling price and their production cost.

The “passive” part kicks in after the initial setup. Once your store is live and your designs are uploaded, sales can happen automatically around the clock. The real work shifts to marketing your brand. This path is perfect for creatives or those with a strong niche community, allowing you to build an asset—a branded e-commerce store—that generates sales while you focus on getting the word out.

The Digital Creator’s Path: Turning Knowledge into Revenue

If you have expertise or a passion that people find valuable, the digital world also offers other incredible platforms and ways to turn that into income. The work is front-loaded—creating the asset—after which it can be sold repeatedly.

YouTube remains a powerhouse.

Creating a channel around a niche you love, from personal finance tips to DIY projects, can generate income through ad revenue, sponsorships, and affiliate marketing. A video you post today can continue to attract viewers and earn money for years, building a library of valuable content.

For those who prefer writing to being on camera, starting a blog is a classic but effective route.

By producing consistent, high-quality content that attracts a steady stream of visitors via search engines, you can monetize through display advertising networks, affiliate marketing (earning commissions for products you recommend), or selling your own digital products.

Speaking of digital products, platforms like Shopify, Etsy, and Gumroad allow you to sell digital downloads, such as printable planners, design templates, or e-books. These products have high profit margins because you create them once and can sell them an unlimited number of times without any inventory or shipping costs. It’s a direct way to monetize a specific skill or creative talent.

The Hands-Off Investor’s Playbook: Your Set-and-Forget Portfolio

Once you have the knowledge and a few active streams running, it’s time to talk about the truly “set-it-and-forget-it” part of your income plan. This is for money you’ve already earned to go out and earn more on its own, with minimal daily attention from you.

The core of this strategy often involves low-cost index fund ETFs (Exchange-Traded Funds) available through any major brokerage like Fidelity or Vanguard. Instead of betting on one or two companies, you buy a single share of a fund that holds small pieces of hundreds of companies, like the entire S&P 500.

You’re buying a slice of the whole economy. Your money grows quietly as those companies grow, and many of these funds pay quarterly dividends, which are small cash payments per share you own. It’s not flashy, but it’s one of the most reliable methods for long-term wealth building, turning market growth into a quiet, background engine for your finances.

For those seeking income that feels more tangible, Dividend Aristocrats are a compelling option. These are well-established companies—think consumer staples or utilities—that have not just paid dividends but have increased them every year for at least 25 years. Investing in a basket of these through a specialized ETF gives you a steadily growing income stream that often outpaces inflation.

The companies are typically stable giants, and their consistent dividend history provides a layer of predictability in an unpredictable market. The money arrives in your brokerage account like clockwork, quarter after quarter, funding your present while the investment itself secures your future.

Final Thoughts: Weaving Your Personal Safety Net

The magic of building towards early retirement doesn’t live in any one platform. It lives in the combination. Relying on a single source of income, even a passive one, is just a different kind of risk. The real security comes from weaving several of these streams together into a personal safety net.

Imagine a month where one income stream slows down, but another kicks in to cover the difference. That’s the resilience you’re building.

Start where you are. If you’re new, begin with the education Finelo provides. If you have a bit of capital, consider a starter investment in a real estate platform or a dividend ETF. The path to early retirement becomes tangible through the quiet, cumulative power of multiple income streams working in the background. It’s the peace of mind that comes from knowing your lifestyle is supported not by a single job, but by a system you built. One smart platform at a time.